Imagine for a moment you were heading out on an adventure, you jump in your car and head straight onto the highway without checking if you had a full tank of petrol to top this off you don’t have a petrol gauge, petrol warning light or computer so you can’t be sure how long your petrol will last.

One thing is for certain if you drive for long enough, you will run out of petrol. It may happen as you are rolling down a hill at the bottom of which is a petrol station. Or it could happen in the middle of nowhere, with your only option to call for help, to try and find someone to tow you and your car to safety.

I am sure this metaphor is clear. The car represents your business, the journey represents your businesses financial sustainability and the petrol gauge, warning lights and built in computer represent Key Performance indicators.

What are Key Performance Indicators and why are they important?

Performance Indicators or Key Performance Indicators (KPI’s) measure the success of your business operations. They measure a wide range of activities. Some hospitality related activities are:

- Customer Satisfaction – how happy your customers are.

- Venue Utilisation – how full your venue is.

- Profitability – how much money your business is making.

If we can’t keep customers happy, our venue’s full, whilst maintaining profitably we will be unable to operate a sustainable business.

“Performance” relates to measuring the elements of an activity. Being chartered accountants by nature our go to KPI are those that measure profitability. Using the example of sales profitability the elements are:

- Customer Satisfaction – how happy your customers are.

- Venue Utilisation – how full your venue is.

- Profitability – how much money your business is making.

If we can’t keep customers happy, our venue’s full, whilst maintaining profitably we will be unable to operate a sustainable business.

“Performance” relates to measuring the elements of an activity. Being chartered accountants by nature our go to KPI are those that measure profitability. Using the example of sales profitability the elements are:

- Inputs – direct cost of sales related to items sold in a given period (weekly, monthly, annually). Think food and beverage costs.

- Inputs – fixed operating costs relating to a given period (weekly, monthly, annually). Think rent, electricity, subscriptions.

- Activity – direct staff costs associated with the production of the food sold in a given period (weekly, monthly, annually). Think staff wages, superannuation.

- Output – revenue related to the sales of food in a given period (weekly, monthly, annually). Think about all revenue streams, food sales, beverage sales, UberEats.

Using performance measure to “indicate” how our business is performing?

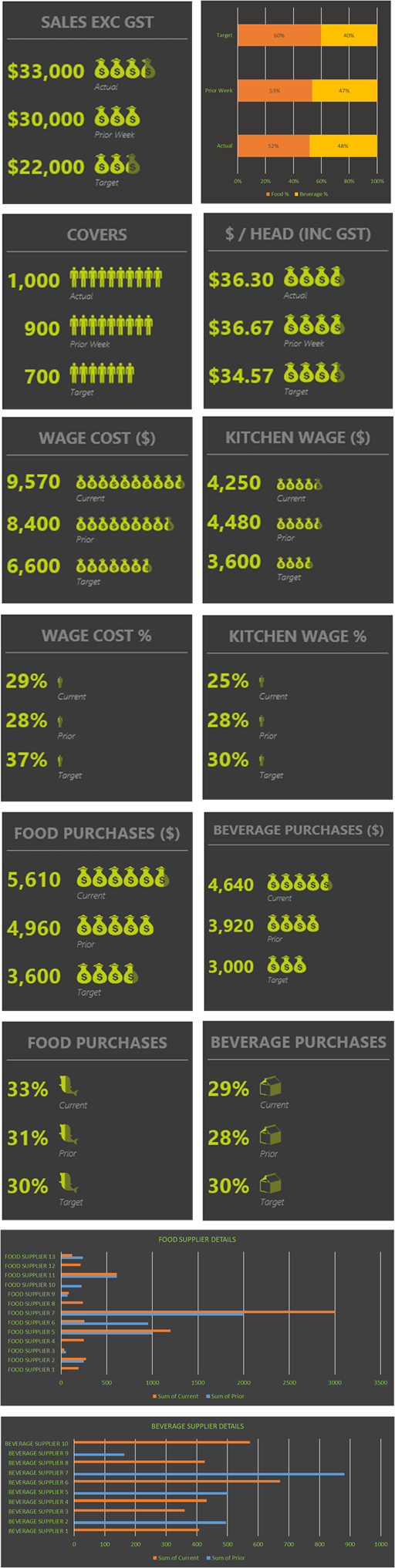

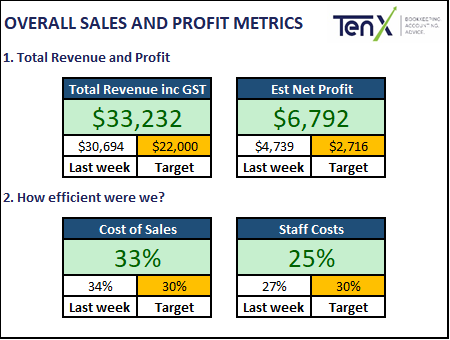

Below is an example of a KPI dashboard.

The dashboard presents the inputs (direct cost of sales and staff costs) and the outputs (total revenue and estimated net profit) of business activity.

We can also see that we are measuring against 2 benchmarks. The first being “last week” and the second being “target”.

We know that in order to maintain our desired profitability we need to:

- Maintain a level of sales

- Keep direct costs to a target % of sales

- Keep staff costs to a target % of sales

Interpreting the KPI’s in our example

- Revenue – we performed above our target and above the previous week. This indicates that we were successful in this area.

- Estimated Net Profit – again we performed above our target and above the previous week. This indicates that we were successful in this area. We note however that the information below suggests we have missed some opportunities.

- Cost of Sales – we performed better than the previous week and worse thane our target. This indicates that we are improving and moving in the right direction towards out cost target. The 3% excess costs would have equated to $906 in Net Profit.

- Staff Costs – we performed above our target and above the previous week. This indicates staffing is extremely efficient. This 5% staffing efficiency has added $1,510 to Net Profit.

How do we measure our KPI’s

- Revenue – we consolidate data from a number of sources including Xero (or alternative), Point of Sale and 3rd Party delivery sites such as UberEats.

- Estimated Net Profit – Net Profit is the outcome of deducting from Revenue cost of sales, staff costs, and an estimated fixed operating expense. In order to estimate we review each businesses fixed costs and break this down in to a weekly figure.

- Cost of Sales – in order to calculate this we need opening and closing stock balances and stock purchases made during the week. We consolidate data from the businesses inventory system (manual or computerised) with the data collected from invoices through our financial management system.

- Staff Costs – we collect all costs associated with the period whether it be timesheet data from Deputy (or similar system), and Salaried Staff information.

Understanding the drivers and adjusting your targets

Targets that we set are based on industry benchmarks and adjusted for each of our clients business. Many non-financial elements have the ability to impact the results and therefore the targets may need to be adjusted to ensure they stay relevant. An example of a change that may cause the targets to be adjusted are specials and discounts. While these are aimed at increasing overall sales some margin may be sacrificed. Examples include Happy Hour, 2 for 1, all you can eat. Whilst targets may need to change it is important that they still indicate what is required to reach your overall business objectives.

Problems

The truth is while business owners understand their importance, monitoring performance indicators is an extremely time consuming and complex task. As a result often these aren’t reviewed regularly enough to spot trouble before it’s too late or to capitalise on opportunities.

How can the team at Ten X Advisors Help?

As part of our cost-effective bookkeeping service we provide our clients with timely reporting of their businesses KPI’s. We tailor this reporting to suit the needs of the different users within your business. For example, business owners and shareholders have different needs to the staff running the kitchen.

Contact the team at Ten X Advisors today to discuss how we can help you understand and measure your business Key Performance Indicators.

Click here to read more about our bookkeeping and accounting services.

Click here to read more about our business reporting services.